Your Ultimate Trading Personality Test

April 23, 2020

Here is a test that you can start with to know if you are psychologically ready to become a forex trader.

1- Do you get angry when you lose a game? Do you seek revenge?

If yes, then chances are you will get even more emotional when you lose a trade especially that your money is at stake. Moreover, you will blame the news, president trump, your strategy, or even your friend who called you while you are monitoring the trade that lost.

If you’re going to be a successful trader, you will have to learn to love taking a loss. Of course, you are not going to be happy to have a losing trade, but you will understand that losses are part of the process and you should be happy to be out of the market when the trade no longer represents a profitable opportunity.

Revenge trading comes from one thing

and one thing only, blaming the market for your loss. But let’s think about

this realistically. Who is responsible when you have a loss? Of course, the

correct answer is you.

The market didn’t cause you to have a loss. Then when you seek revenge for the

loss you received, you are actually trying to get revenge against yourself.

The best fighter is never angry. ~ Lao Tzu

2- Do you think you are always right?

Ego always wants to be right. In the markets, we as traders are not seeking to be right or wrong; we are seeking to make money.

Your ego is your biggest enemy when it comes to trading. Because when you get too confident in your trading, you will not follow the rules as per your trading plan when believing that you are too good and that most of your trades will end up winning no matter what.

If you let ego control your decisions in the markets, you will end up in a pool of losses with nothing learned but psychological and emotional pain.

If you know a trader with an ego through the roof, he is not a trader, you may call him analyst, or instructor, or even a scammer, but not a trader.

Know what you know and know what you don’t. And no matter how good you think you are, remember to stay humble, for if you don’t, the market will do it for you.

3- Do you fasten your seatbelt every time you drive?

If you don’t fasten your seatbelt, means that you think that you are too good to make an accident.

Hopefully, you will not make any accidents, but we both know that one accident can ruin your life especially if you weren’t wearing a seatbelt.

SUBSCRIBE TO OUR NEWSLETTER

and get Free Weekly Trade Setups and Tips

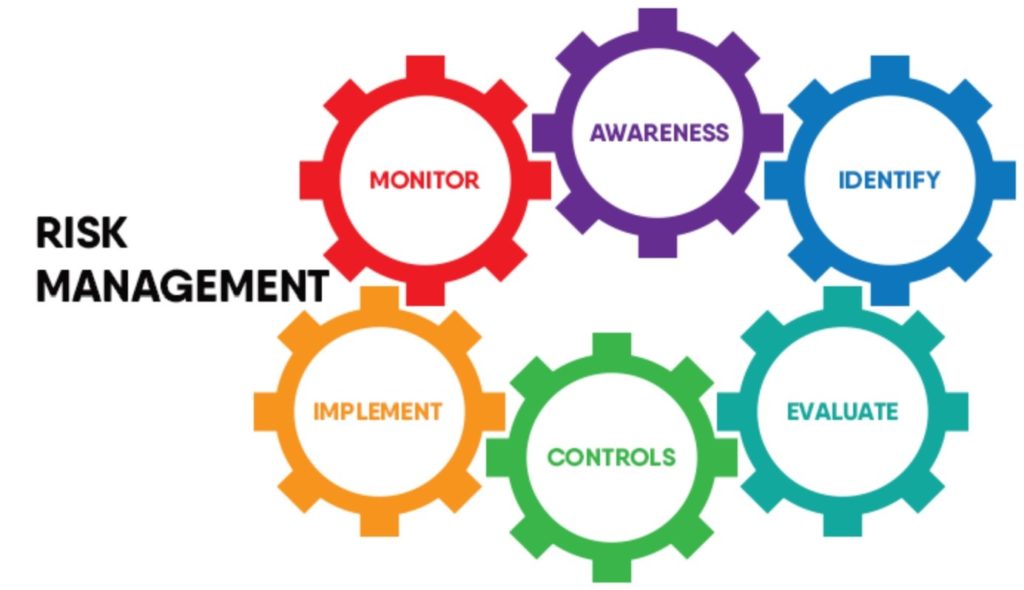

We would rather call ourselves Risk-Managers not only Traders. As the only thing we have control on is our risk. The market can go anywhere.

Professional traders think Risk, not Reward. No matter how good is your trading strategy, if you don’t manage your risk well and find ways to put the odds in your favor, you will not make it in trading.

Trading without a stop loss is like driving without your wearing a seatbelt. One trade can blow your account.

4- Are you a follower?

As a trader, you should never copy or follow blindly other trader’s analysis on social media or trading networks.

You chose forex to be your own boss, why do you insist on being a follower?

Moreover, do not doubt your strategy, entry, just because your fellow traders offline/online disagree with your position direction.

The odds of being right aren’t with the crowd.

The only way to make money, in forex or trading in general, is to trade by yourself and to be in full control of your account by following a well-defined trading plan that you implement objectively like a robot.

You’re the one in charge of your trading. You alone are responsible for your success or failure as a trader. It is not the market… nor another trader… nor the trading system… nor the government or its news releases that are responsible.

Develop your own trading style that suits your personality, time, and expectations and follow it with full focus.

“If you don’t design your own life plan, chances are you’ll fall into someone else’s plan. And guess what they have planned for you? Not much.” ~ Jim Rohn

5- Do you finish your popcorn before the movie starts?

For example, if you are not usually patient as a human, chances are, you will not be patient while trading.

As a trader, 90% of your time is

waiting. That’s why you need to be patient.

First, you have to wait for the setup to form, and once you are in a trade,

wait for your trade to hit stop loss or take profit.

“The stock market is a device for transferring money from the impatient to the patient.” ~ Warren Buffett

6- Are you usually committed to diet/gym? Are you into long-term relationships?

The successful trader stays focused and sticks to his system/methodology.

Just like you get married. You chose to spend the rest of your life with your partner, knowing that you may find someone better, smarter, more beautiful… but you are done searching. (Unless you want to cheat on your partner)

Stop searching, for new methodologies. If your strategy is profitable. Then focus on it, master it, and repeat. You have got a money machine.

Do not change methodologies week after week.

Have you ever been in a marathon or planning to? Consistency and Determination is the key.

Choosing to learn from your own mistakes rather than giving up is what determines a winning mindset.

Just like trading,

you pace yourself to win the long-distance trading race.

Successful trading is supposed to be boring.

7- Can you wait for the green traffic light?

To achieve success in forex trading, the first step would be to develop a good trading strategy with well-defined set of rules and to follow it objectively.

Having the discipline to follow up your trading plan/rules is the surest way to build your trading career and make consistent profits over the long term.

Self-discipline is NOT a trait that you are born with. Anyone can practice self-discipline, but it isn’t as easy as it sounds.

“Just like Rome wasn’t built in a day”

Nobody becomes successful overnight. It takes time, strategy, discipline, and consistent trading until your efforts pay off.

The market pays you to be disciplined. Be disciplined every day, in every trade, and the marker will reward you.

If you decide to trade without any rules, I promise you will not be successful.

Freedom is good, but you need to have what I call “structured freedom.”

In brief, everyone can be a forex trader, but not anyone. Successful traders are made not born.

To be a successful trader, you need to work on developing yourself as a trader in many aspects like risk management, problem-solving, flexibility and trading psychology.

To be able to work on your trading psychology, first, you need to start from the core and work on your human psychology.

Join our community and learn how to control

your emotions in a practical way.

www.RichTL.com